Do you have a high net worth? Get Your FREE Copy Now.

Do you have a high net worth?

Get Your FREE Copy Now.

10 Common Financial Mistakes High-Net-Worth People Make

A Framework for Investment and Wealth Management

10 Common Financial Mistakes High-Net-Worth People Make

A Framework for Investment and Wealth Management

Just by reading this Ebook, you will be ahead of others who haven't.

The Proven Framework For Investment and Wealth Management for Families With $1M to $50M+ In Investable Assets

What's Inside This FREE Ebook?

How to Avoid the 10 Biggest Financial Mistakes Investors Make

There are endless reasons investors fail to stay true to their wealth plan, but in this eBook we'll show you 10 common mistakes.

The Keys to Financial Success

Different investments will have varying risk and return potential - make sure you plan.

The Best Long-Term Investment Strategies & Plans

Failing to strategize can result in higher taxes and lower performance. Define how much risk you're comfortable with to save you money in the end.

How You Can Save $50,000 per $5 Million in Assets

Look at the location of your assets and consider the impact of future minimum distributions.

What's Inside This FREE Ebook?

How to Avoid the 10 Biggest Financial Mistakes Investors Make

There are endless reasons investors fail to stay true to their wealth plan, but in this eBook we'll show you 10 common mistakes.

The Keys to Financial Success

Different investments will have varying risk and return potential - make sure you plan.

The Best Long-Term Investment Strategies & Plans

Failing to strategize can result in higher taxes and lower performance. Define how much risk you're comfortable with to save you money in the end.

How You Can Save $50,000 per $5 Million in Assets

Look at the location of your assets and consider the impact of future minimum distributions.

What You Don't Know Has a Price.

Get equipped with the right knowledge and start avoiding the common pitfalls high-net-worth people fall for along the way.

OUT with uncertainty. IN with peace of mind.

What You Don't Know Has a Price.

Get equipped with the right knowledge and start avoiding the common pitfalls high-net-worth people fall for along the way.

OUT with uncertainty. IN with peace of mind.

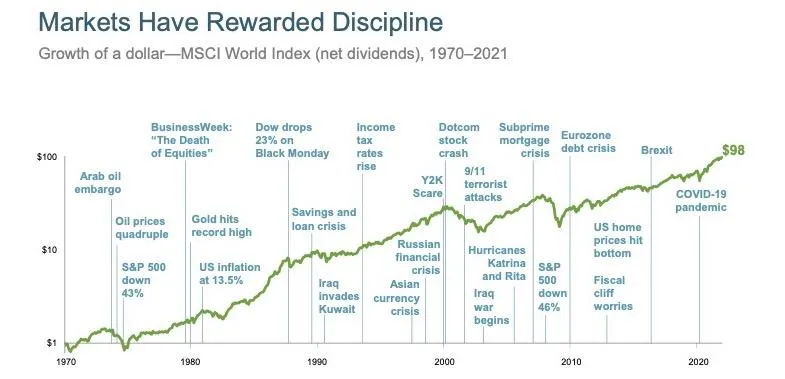

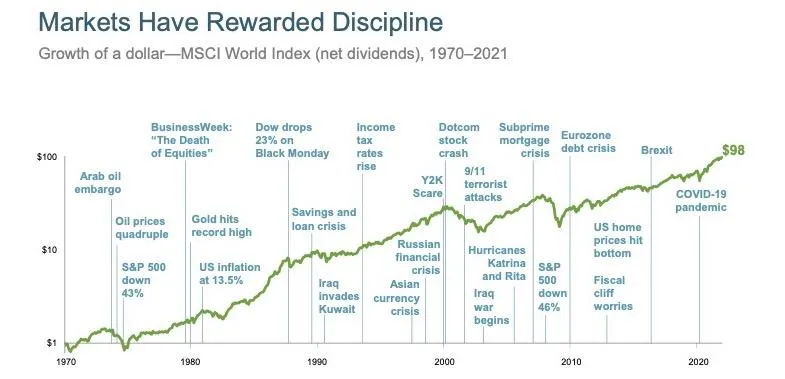

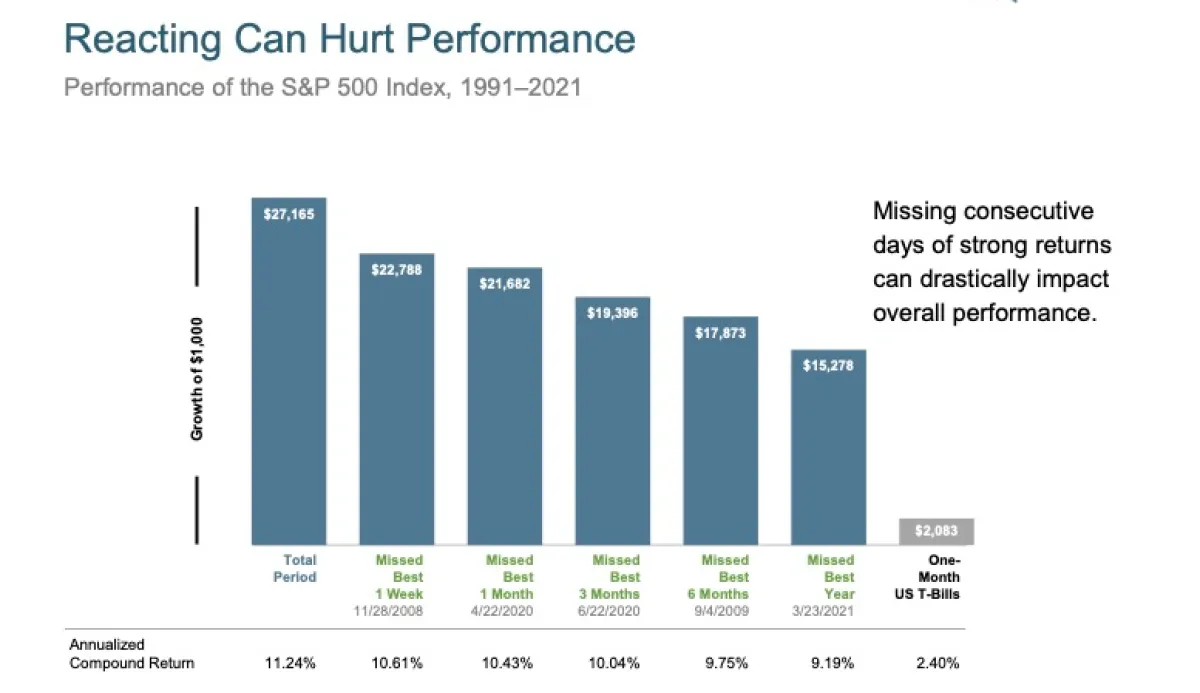

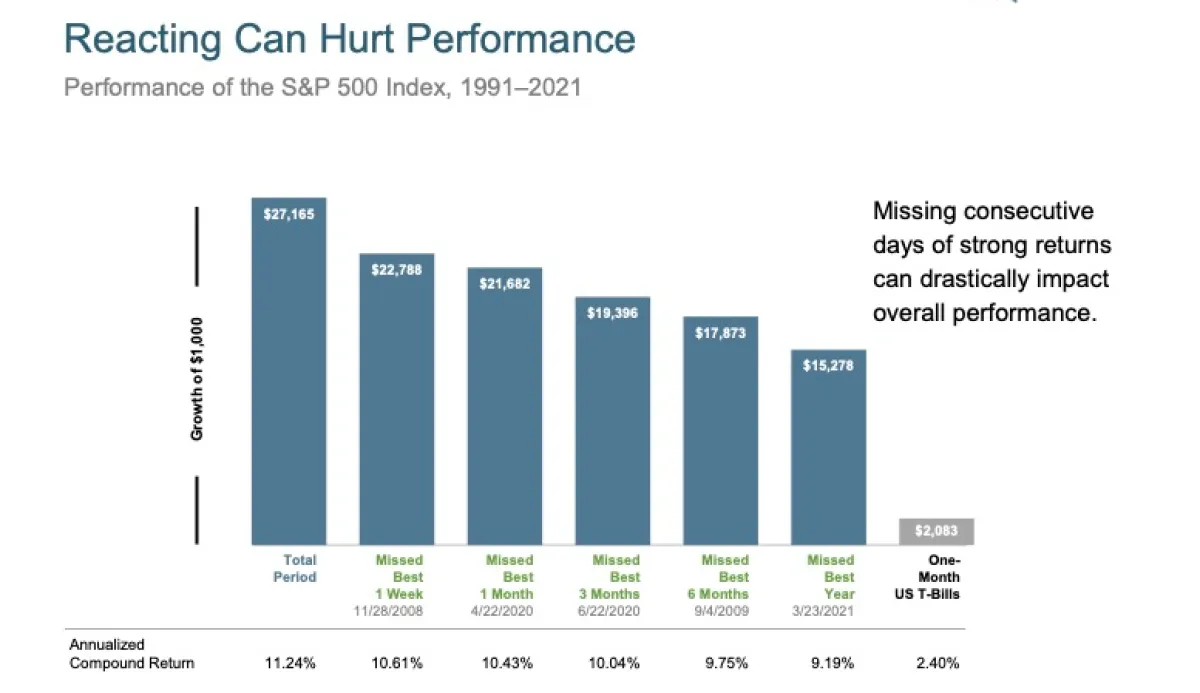

The Numbers Don't Lie

There are elements within your control and those that are not. Focusing on what is within your control and avoiding mistakes will lead to capturing the market return you have earned and minimizing cost!

The Numbers Don't Lie

There are elements within your control and those that are not. Focusing on what is within your control and avoiding mistakes will lead to capturing the market return you have earned and minimizing cost!

Get Your Free Copy Now

You've worked hard to get to this point in your life and should be enjoying the wealth you've earned. This ebook is a step in the right direction.

Get Your Free Copy Now

You've worked hard to get to this point in your life and should be enjoying the wealth you've earned. This ebook is a step in the right direction.

Investing FAQs

How can I protect my wealth?

Protecting your wealth is an ongoing effort. It includes combining investment, retirement, tax, and estate planning to reduce tax obligations but also ensure an orderly transfer of wealth to the next generation.

What strategies can be used to reduce the taxes on investments?

Strategies can include the reduction or deferral of income, capital gains, and estate taxes. Other strategies such as asset location and investment selection help you keep more of your return and reduce tax obligations from the start.

What is tax-efficient investing?

While you can't control your investment return or tax rates, you can ensure that you minimize tax obligations through a number of tax-efficient investing strategies including investment approach and selection, saving and withdrawal strategies, and tax-loss harvesting.

Do I need wealth management?

You may feel you don't have the time to devote to your wealth, or the expertise to combine several disciplines, or you may simply want a trusted partner to work with you. While there is a cost to wealth management, if the hurdle is low, advisors can outperform their cost and help you keep more of your return.

Investing FAQs

How can I protect my wealth?

Protecting your wealth is an ongoing effort. It includes combining investment, retirement, tax, and estate planning to reduce tax obligations but also ensure an orderly transfer of wealth to the next generation.

What strategies can be used to reduce the taxes on investments?

Strategies can include the reduction or deferral of income, capital gains, and estate taxes. Other strategies such as asset location and investment selection help you keep more of your return and reduce tax obligations from the start.

What is tax-efficient investing?

While you can't control your investment return or tax rates, you can ensure that you minimize tax obligations through a number of tax-efficient investing strategies including investment approach and selection, saving and withdrawal strategies, and tax-loss harvesting.

Do I need wealth management?

You may feel you don't have the time to devote to your wealth, or the expertise to combine several disciplines, or you may simply want a trusted partner to work with you. While there is a cost to wealth management, if the hurdle is low, advisors can outperform their cost and help you keep more of your return.

Avoid Mistakes and Gain Peace of Mind

Preserve and Grow Your Wealth with the Right Financial Strategy

Growing your wealth takes time and effort. Being aware of the potential pitfalls and knowing how to avoid them is key to financial success.

Investing knowledge is investing power:

Feel confident making decisions

Have peace of mind

Pass your wealth to the next generation

Avoid Mistakes and Gain Peace of Mind

Preserve and Grow Your Wealth with the Right Financial Strategy

Growing your wealth takes time and effort. Being aware of the potential pitfalls and knowing how to avoid them is key to financial success.

Investing knowledge is investing power:

Feel confident making decisions

Have peace of mind

Pass your wealth to the next generation